Summary

We are excited to announce our investment in Amber, Australia’s most popular energy retailer for home battery owners. For a monthly subscription fee, Amber gives customers access to real-time wholesale electricity prices, allowing them to charge their batteries and EVs when wholesale prices are cheap, and then sell power when prices spike to earn income. All of this is controlled by smart automated battery control software which maximises the economics for customers.

The Opportunity

By 2030, Australia’s energy market operator expects Australians to own the equivalent of five million home batteries or electric vehicles (EVs)[1]. Thanks to government rebates and falling battery costs, these technologies are more affordable than ever – which has accelerated their uptake.

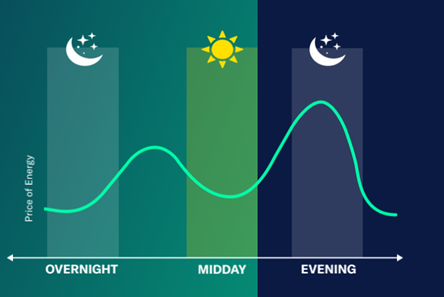

Furthermore, as more renewables enter the grid, wholesale power prices are becoming increasingly volatile: power is cheap (and often free) in the middle of the day when renewables are abundant and expensive at the morning and evening peaks.

Battery owners have historically been unable to take advantage of this volatility. They’re faced with limited options: consuming their own power, selling to the grid at low (and falling) flat feed-in-tariffs or handing over control and joining virtual power plants run mainly for the benefit of big electricity retailers.

Daily power price curve (source: Amber)

Enter Amber: Providing customers the solution

Amber gives customers the best mix of economics and control. For many battery owners, Amber delivers more than $1,000 a year in extra value compared to them storing and using their own stored energy[2]. And unlike traditional VPPs, Amber doesn’t require customers to surrender control of their assets to the retailer – they can choose when to charge and discharge. Or they can rely on Amber’s automation engine which designs a plan around each household’s usage profile, delivering optimisation without complexity.

Amber has already built strong momentum in Australia with over 50,000 customers. It is now looking to replicate its success globally, licensing a white label version of the product to international retailers to roll out to their customers. Major partnership agreements have been signed with E.ON in the UK and Germany (E.ON serves over 45 million customers across Europe [3]), and with Ecotricity UK – a leading clean energy retailer.

The Founders’ Story

We have followed co-founders Dan Adams and Chris Thompson for seven years and have been impressed by their deep energy insights and complementary expertise. The pair first met at Boston Consulting Group (BCG), before Dan went on to hold senior roles at Tesla, while Chris became a senior MD at Bamilo (Iran’s largest eCommerce platform).

The Founders of Amber, taken from https://www.forbes.com.au/news/innovation/amber-electric-energised-with-45m-raise/

Why We Invested

- A win for customers, retailers, and the grid: Amber’s model delivers value across the ecosystem: 1) customers benefit from wholesale price volatility without complexity; 2) batteries and EV owners earn thousands in additional income annually, encouraging rapid uptake; 3) energy retailers retain and delight their best customers; and 4) the grid benefits from demand shifting to periods of high renewable supply.

- Proven ability to execute: Amber has translated their bold vision into measurable impact: with over 50,000 customers currently, and partnerships with Europe’s largest utilities. This track record gives us confidence in their ability to scale internationally and grow international market share.

- Team strong in execution and growth: We believe Dan and Chris are an exceptional founding duo—combining sector insight, product vision, and proven execution. They’ve built a product customer’s genuinely love and have shown the execution capability required to scale a category-defining product globally.

We look forward to helping the Amber team as they accelerate the world towards renewable energy. For further details or any questions, please reach out to Alex Oppes.

[1] AEMO 2024 ISP, Green Energy Exports Scenario. 141 GWh of CER, shallow and medium storage equates to 5 million batteries or EVs with an average of 28 kWh capacity. https://www.aemo.com.au/energy-systems/major-publications/integrated-system-plan-isp/2024-integrated-system-plan-isp

[2] https://www.amber.com.au/blog/getting-paid-for-your-power-why-more-households-are-installing-batteries#:~:text=The%20numbers%20don’t%20lie&text=Yep%20%2D%20the%20grid%20actually%20paid,real%2Dtime%20price%20of%20energy