Kwetta: Investment Notes

Summary We are excited to announce our investment in Kwetta, a New Zealand-based business commercialising a novel solution for ultra-fast

Stay up to date with

Virescent Ventures news

Summary We are excited to announce our investment in Kwetta, a New Zealand-based business commercialising a novel solution for ultra-fast

Queensland Investment Corporation (QIC) has been announced as a major investor in Virescent Ventures’ second climate technology fund (Fund II),

Australia’s largest and most active dedicated climate tech VC, Virescent Ventures has completed a $100 million first close of its

Blair Pritchard is a Partner at Virescent Ventures and has led Virescent’s Seed, Series A and Series B investments in

Summary We are excited to announce our investment in Xefco, a Geelong-based start-up that has developed a novel technology for

The Trailblazer for Recycling & Clean Energy and Virescent Ventures back UNSW Founders’ Climate 10x accelerator program The Trailblazer for

Virescent Ventures has announced that they have deployed over $260m in capital into 33 Australian climate tech startups. Established in

Australian battery recycling startup Renewable Metals has closed an $8 million investment round to scale and commercialise its groundbreaking lithium-ion

Virescent Ventures has backed HydGene Renewables, a new Australian company that has developed an alternative green hydrogen solution that turns

Virescent Ventures portfolio company Novalith Technologies has announced their A$23m Series A to build a processing plant that uses their

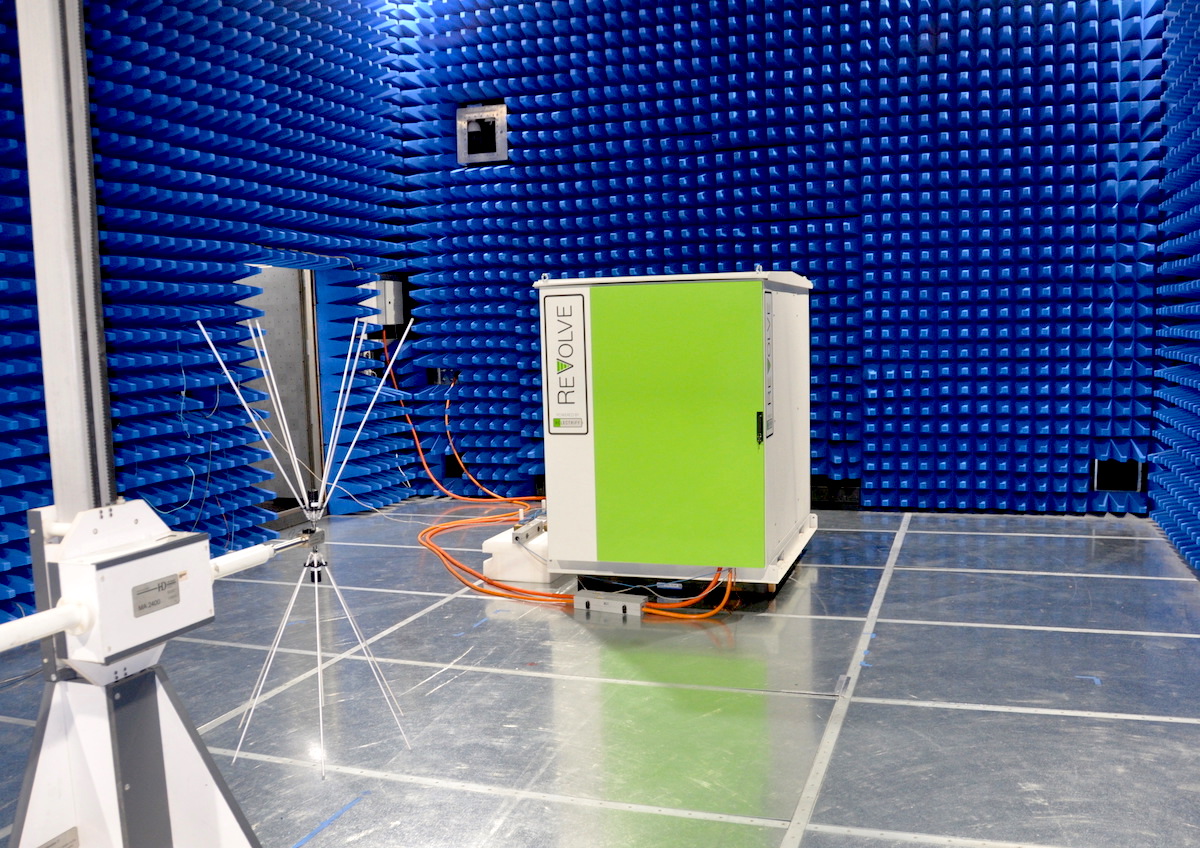

Virescent Ventures portfolio company Relectrify today announced the ReVolve® energy storage product, featuring its patented cell-level control technology, has achieved

Virescent Ventures portfolio company, Loam Bio, is launching into the Australian market after years of product development and its latest

Virescent Ventures portfolio company Samsara Eco, using plastic-eating enzymes to produce recycled packaging, has banked $54 million Series A funding

Clean Energy Finance Corporation (with funds managed by Virescent Ventures) co-lead the $21 million Series A investment in Australian company

Synthetic dairy producer All G Foods has raised $25 million to turbocharge the production of its milk alternative, with UK-based

Hysata, an Australian hydrogen technology company, has raised more than $40 million to fund its expansion after revolutionising the development

Are you our next ambitious founder with a bold vision to reduce emissions?

In association with Clean Energy Finance Corporation

© copyright 2025 Virescent Ventures

The Virescent Ventures group of companies (the Virescent Ventures Group) includes various entities who are corporate authorised representatives (CAR) of Boutique Capital Pty Ltd ACN 621 697 621 (Boutique Capital) AFSL 508011. The full list of entities is detailed below. Any information or advice is general advice only and has been prepared by the Virescent Ventures Group for individuals identified as wholesale investors for the purposes of providing a financial product or financial service, under Section 761G or Section 761GA of the Corporations Act 2001 (Cth). Any information or advice given does not take into account your particular objectives, financial situation or needs and before acting on the advice, you should consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If any advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument and consult your own professional advisers about legal, tax, financial or other matters relevant to the suitability of this information. Any investment(s) summarised are subject to known and unknown risks, some of which are beyond the control of the Virescent Ventures Group and their directors, employees, advisers or agents. The Virescent Ventures Group does not guarantee any particular rate of return or the performance, nor does The Virescent Ventures Group and its directors personally guarantee the repayment of capital or any particular tax treatment. Past performance is not indicative of future performance. All investments carry some level of risk, and there is typically a direct relationship between risk and return. We describe what steps we take to mitigate risk (where possible) in the investment documentation, which must be read prior to investing. It is important to note that risk cannot be mitigated completely. Full list of entities: Virescent Ventures Pty Ltd ACN 655 534 660 CAR Number 1295417, Virescent Ventures II Staple Co A Pty Ltd ACN 658 206 814 CAR Number 1298514, Virescent Ventures II Staple Co B Pty Ltd ACN 677 832 281 CAR Number 1310668, Virescent Ventures II Management, LP ILP2200036 CAR Number 1298515, Virescent Ventures II, LP ILP2200037 CAR Number 1298516.